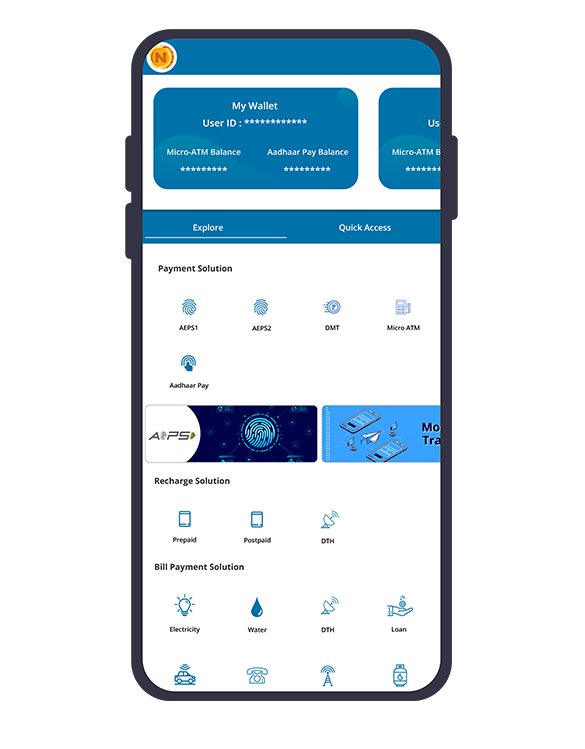

Aadhaar Enabled Payment System

Easily get your money through biometric process instantly anywhere in India.

Learn MoreDomestic Money Transfer

Transfer your money from one account to another anywhere from all over India.

Learn MoreBill Payment

Pay all your dues from single portal without travelling from one place to another.

Learn MoreMultiple Recharge

Now easily recharge any operator at one stop shop available at all retail shop.

Learn MoreDigital Lending

Easily get your loan instantly through our portal (Home loan, Gold Loan, Loan Against property).

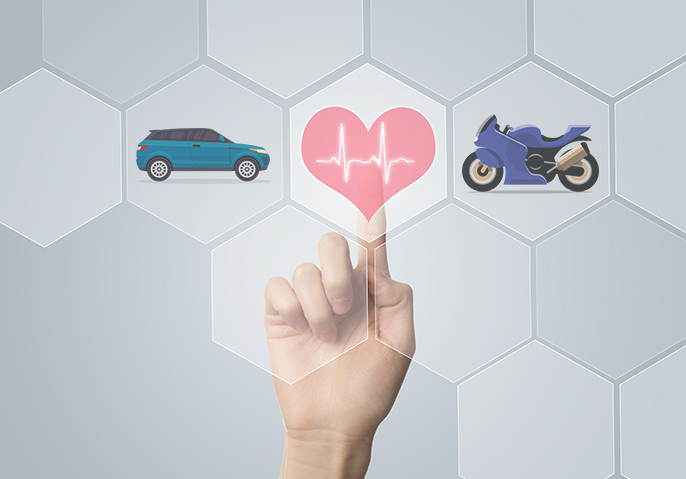

Learn MoreSecure with Insurance

Don't worry for your health and vehicles, secure it with netpaisa insurance facilities.

Learn MoreDigital Lending Solution

Gold Loan

- Minimal Documentation

- No credit history needed

- Reasonable Interest rates & reasonable processing fee.

Home Loan

- Tax Benefit

- Pay in easy monthly installments

- Low Interest rates & reasonable processing fee.

Loan Against Property

- Enjoy a lower interest rates

- Obtain a large sanction

- Get tax benefit on interest payment

SME

- Short term commitment

- Easy loan disbursement

- Get funds for everyday operation/machinery.